Introduction to Technical Analysis:

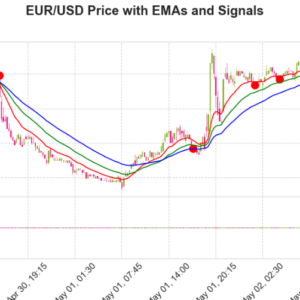

Technical analysis is a term many of you will be familiar with. It evokes images of trendlines and patterns like head and shoulders or cup and handles, Flags, and Triangle patterns. There are many different styles of technical analysis, but ultimately technical ideas should all derive from the same practice, studying historical market data, through price and volume to forecast ideas on current charts.

On one hand, the idea makes sense at face value. Why shouldn’t the same factors that drove price in the past be present in the future when similar price action will occur? On the other hand, some would ask what happened in the past has anything to do with what might happen in the future?

When we think about what drives the behaviour of price on a chart, we need to remember that although price moves “randomly” it does not move without reason. Price moves with the buying and selling of an asset. Positions opening and closing, and behind those positions are people, and those people have predictable behavioural tendencies.

I do not subscribe to the majority of the “technical analysis” ideas you might see being commonly used, but what I do believe is that the methodology of technical analysis has a lot of merit. That’s why in this post we will discuss the Top 5 Technical Analysis Books for Day Trading.

Let’s begin by examining each book individually. The term “Top 5” doesn’t imply a hierarchy, where the top-ranked book provides more knowledge than the others. Each book offers unique insights to aid in learning technical analysis. We will talk about practical applications of the methods in diverse trading domains such as algo trading, forex trading, and stock trading. Additionally, we’ll highlight the specific topics covered in each book.

1. “Technical Analysis of the Financial Markets” by John J. Murphy

Overview:

John J. Murphy’s seminal work, “Technical Analysis of the Financial Markets,” serves as a cornerstone for traders worldwide. Its exhaustive content covers a spectrum of technical analysis tools applicable across diverse financial instruments, including stocks, commodities, and forex.

Murphy Goes through all the major methods in this book, after reading this book you would be able to begin technical analysis and charting, but don’t expect that all the methods will work, because the golden era of technical analysis was in the 80s when a lot of methods shown in this book has a lot of success. The game has changed a lot now, but most of the methods are still valid and this book is must read if you are a beginner in the stock market.

- Key Topics Covered:

Trusted Author: John J. Murphy is a big name in the stock market world. He knows his stuff, and that makes the book reliable. - Everything in One Place: The book talks about a lot of things in the stock market. It’s like having a manual that covers everything from start to finish.

- Easy to Understand: Murphy doesn’t use complicated words. Even if you’re new to this, the book is easy to read and get into.

- Cracking the Code of Charts: Wondering what those charts mean? Murphy explains it all. You’ll learn how to read those lines and figures on stock charts.

- Tools of the Trade: Murphy introduces tools that traders use. It’s like learning about the different gadgets in a toolbox that helps understand the market.

- Seeing the Big Picture: He talks about how different markets affect each other. It’s like realizing that everything is connected, which is important in the stock market.

- Spotting Patterns: Murphy makes recognizing patterns easy. Whether it’s a triangle or a double top, you’ll be able to see these patterns on charts.

- Keeping Your Money Safe: He talks a lot about keeping your money safe. Murphy gives ideas on how not to lose too much, which is really important for anyone trading.

- Economic Clues: You’ll understand how economic news affects the stock market. Murphy connects the dots between economic stuff and how prices move, making it less confusing.

- Real-Life Examples: The book doesn’t just talk; it shows with examples. Real stories and situations help you see how these ideas work in the real world.

2. “A Complete Guide to the Futures Market” by Jack D. Schwager

Overview:

Jack D. Schwager’s “A Complete Guide to the Futures Market” provides a comprehensive exploration of technical analysis within the futures market context. Traders keen on diversifying into futures or incorporating them into their portfolio will find Schwager’s insights invaluable.

- Key Topics Covered:

Expert Guidance: Jack D. Schwager knows his stuff in the financial world. His experience makes the book a trustworthy guide. - All-in-One Package: It covers everything about the futures market, from the basics to fancy strategies. It’s like having a complete toolkit for anyone interested in futures.

- Easy to Understand: The book explains things in simple language. Even if you’re new to all this, you won’t feel lost.

- Watch Your Back – Risk Management: Schwager talks a lot about keeping your money safe. He gives good advice on how to handle risks, which is super important.

- Inside the Trader’s Mind: Ever wondered what’s going on in a trader’s head? Schwager talks about the feelings and thoughts that can affect how people trade. It’s like getting a peek behind the scenes.

- Real-Life Examples: The book isn’t just full of theories. Schwager shows real examples of how different strategies work in the real world. It’s learning by doing.

- Cracking the Market Code: Schwager explains how to analyze the market. Whether you like numbers or charts, he’s got you covered with different ways to understand what’s happening.

- Demystifying Jargon: If terms like derivatives and futures contracts sound like a foreign language, don’t worry. Schwager breaks them down so anyone can understand.

- Thinking Global: The book doesn’t just focus on one place. It looks at futures markets worldwide. It’s like getting a global perspective on how things work.

- Up-to-date Info: Schwager keeps things current. The book is updated to match what’s happening right now in the market. You won’t be reading old news.

3. “Japanese Candlestick Charting Techniques” by Steve Nison

Overview:

Steve Nison’s “Japanese Candlestick Charting Techniques” While reading this book’s first part I found it boring because a lot of methods of this book are easily available in a lot of trading software and we can do analysis based on candlesticks without reading this book but in the second part of the book I learned about a lot of in-depth knowledge about candlestick charting and small things about charting which helped me a lot when I tried to code my price action based trading strategies.

- Key Topics Covered:

Candlestick Pioneer: Steve Nison’s expertise in introducing Japanese candlestick charting to the West is evident throughout the book. He’s a professional in the field, and his insights are invaluable. - All-Inclusive Candlestick Education: This book is your go-to guide for everything candlesticks. It covers a wide range of candlestick patterns, from the basics to the more intricate ones, making it a comprehensive resource.

- Historical Insights: Nison takes you back in time to understand the roots of candlestick charting in Japan. This historical context adds depth to your understanding, connecting the patterns to their cultural origins.

- Practical Application in Trading: What sets this book apart is its practicality. Nison doesn’t just throw information at you; he shows you how to use candlestick patterns in real-world trading scenarios, making it applicable and actionable.

- Visual Recognition: The book excels in aiding pattern recognition. With clear explanations and visual aids, you’ll find yourself quickly identifying candlestick patterns on your charts.

- Integration with Western Analysis: Nison seamlessly combines Japanese candlestick techniques with Western analysis methods. This fusion provides a well-rounded approach, giving you a more holistic view of market movements.

- Universal Applicability: Whether you’re into stocks, forex, or commodities, the principles of candlestick charting outlined by Nison are universally applicable. It’s a versatile tool for traders across various markets.

- Beyond Patterns: The book doesn’t stop at individual patterns. Nison dives into strategic insights, showing you how to use candlestick analysis for trend identification, reversals, and understanding market sentiment.

- Educational Structure: The book’s educational structure is well-thought-out. Nison takes you on a journey, starting with the basics and gradually building up to advanced patterns and trading strategies, ensuring a smooth learning curve.

- Timeless Wisdom: Despite being written some time ago, this book’s principles remain timeless. Nison’s teachings continue to be relevant, making “Japanese Candlestick Charting Techniques” a must-read for traders looking to master the art of candlestick analysis.

4. “Technical Analysis Explained” by Martin J. Pring

Overview:

Martin J. Pring’s “Technical Analysis Explained” is here to help both Novice traders and Professional traders, offering a comprehensive guide to technical analysis. The book covers Dow Theory, momentum, price patterns, and various technical indicators.

Key Topics Covered:

- Author Know-How: Martin J. Pring, the author, really knows his stuff. With tons of experience, he breaks down complex concepts into easy-to-understand bits.

- Getting the Basics Right: This book lays a solid foundation by explaining all the basic terms and techniques used in technical analysis. It’s great for beginners.

- Spotting Patterns and Trends: Pring shows you how to recognize patterns in charts that can help you spot trends and potential trading opportunities. It’s like learning the language of the market.

- Easy on Indicators: Confused about indicators? Pring simplifies things by explaining popular ones like Moving Averages, RSI, and Stochastic Oscillator in a way that’s not overwhelming.

- Feeling the Market Vibes: Ever heard of market sentiment? The book makes it easy to grasp, helping you understand how feelings in the market can affect prices.

- Connections Between Markets: It introduces the idea of looking at different markets together. You’ll see how changes in one market can impact another. It’s like seeing the bigger picture.

- Making Sense of Numbers: Economic indicators sound complicated, right? Pring breaks it down, showing how things like job numbers and GDP can influence the markets.

- Guarding Your Money: Risk management might sound boring, but it’s crucial. This book gives simple strategies to protect your money and avoid big losses.

- Understanding Trader Emotions: Pring brings in psychology, explaining how emotions drive market moves. Understanding this is like having an extra tool in your trading kit.

- Putting Ideas into Action: The best part is the practical side. It’s not just theory – Pring uses examples and case studies, so you can see how to apply what you’ve learned in real trading situations.

5. “Encyclopedia of Chart Patterns” by Thomas N. Bulkowski

Overview:

Thomas N. Bulkowski’s “Encyclopedia of Chart Patterns” is a comprehensive reference guide that focuses on chart patterns and their significance in technical analysis. The book is a valuable resource for traders seeking to enhance their pattern recognition skills.

Key Topics Covered:

- Pattern Encyclopedia: Bulkowski’s book is like a treasure trove for chart pattern enthusiasts. It’s packed with a vast array of chart patterns, making it a go-to reference for pattern recognition.

- Author’sExpertise: Thomas N. Bulkowski is an authority when it comes to chart patterns. His expertise shines through, providing readers with valuable insights and practical knowledge.

- Detailed Pattern Analysis: Each chart pattern is meticulously analyzed, with details on how to identify and interpret them. The book leaves no stone unturned, making it easy for readers to grasp the nuances.

- Performance Statistics: What sets this book apart is the inclusion of performance statistics for each pattern. Bulkowski provides data on how often patterns succeed or fail, helping traders make informed decisions.

- Candlestick Patterns Included: It’s not just about regular chart patterns; the book also covers candlestick patterns. This comprehensive approach gives traders a broader perspective on price movements.

- Real-world Examples: Bulkowski doesn’t just stop at theory. The book is loaded with real-world examples, allowing readers to see how these patterns played out in actual market situations.

- Identification Tips: Worried about getting lost in the patterns? Bulkowski provides practical tips on how to identify patterns effectively, making it accessible for traders at all skill levels.

- Probability and Risk Assessment: The inclusion of probability and risk assessment adds a practical touch. Traders can gauge the likelihood of a pattern’s success and understand the associated risks.

- Interactive Approach: The book engages readers with an interactive approach. It’s not just about reading – Bulkowski encourages traders to apply the knowledge and test patterns in real market scenarios.

- Comprehensive Reference: Whether you’re a beginner or an experienced trader, this book serves as an excellent reference guide. It’s organized in a way that makes it easy to find the information you need when you need it.

Final Thoughts:

The top five technical analysis books provide a wealth of knowledge applicable across different markets, including forex. Traders can leverage these resources to develop a nuanced understanding of technical analysis, enhance their skills in backtesting, and even venture into algorithmic and systematic trading. Continuous learning and practical application of these principles are key to success in the dynamic world of financial markets. Checkout my Other Blogs Here.