Monte Carlo Simulation

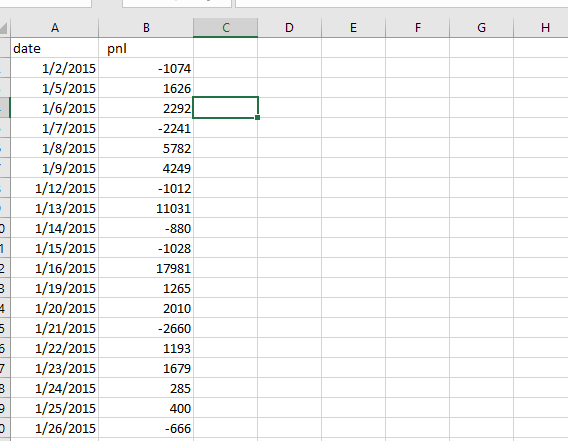

Instructions for CSV: The CSV file should have two columns: "date" and "pnl". The "Date" column should contain date strings in the format "YYYY-MM-DD". The "pnl" column should contain the corresponding Values of profit and loss.

What is Monte Carlo Simulation:

Monte Carlo simulation, named after the renowned Monte Carlo Casino in Monaco, is a computational technique used to understand the impact of uncertainty and risk in various fields, including finance and trading. In trading, Monte Carlo simulation serves as a powerful tool to assess the potential outcomes of a trading strategy under different scenarios by generating numerous random simulations based on input variables such as asset price movements, market volatility, and other risk factors.

By repeatedly running these simulations, each time with slightly different inputs drawn from probability distributions, Monte Carlo simulation provides traders with a range of possible future outcomes, enabling them to assess the robustness and reliability of their trading strategies. This technique helps traders make more informed decisions by quantifying the risks associated with their investment approaches and identifying potential weaknesses or vulnerabilities in their strategies.

Monte Carlo simulation can be particularly useful in evaluating complex trading strategies or investment portfolios that involve multiple assets and intricate risk-return profiles. By incorporating factors such as historical market data, asset correlations, and volatility patterns, traders can gain insights into how their strategies may perform across various market conditions and better prepare for different scenarios.

Overall, Monte Carlo simulation offers traders a systematic approach to risk management and decision-making, allowing them to optimize their trading strategies, manage expectations, and navigate the uncertainties of financial markets more effectively.

Read More about Monte Carlo simulation here.

How To Use this simulator:

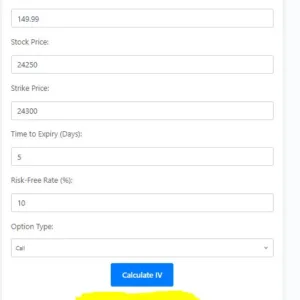

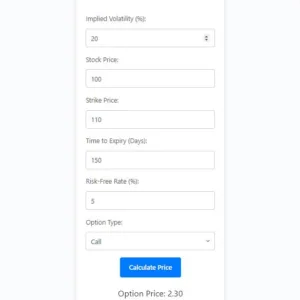

- Prepare Your Data:Ensure your trading data is in CSV (Comma Separated Values) format, with columns for ‘Date’ and ‘PnL’ (Profit and Loss).Each row should represent a single trading day, with the corresponding PnL value for that day.

- Upload Your CSV File:Use the provided interface to upload your CSV file containing the trading data.

Once uploaded, the system will display the file name for confirmation.(See Below Image to see what data should look like:)

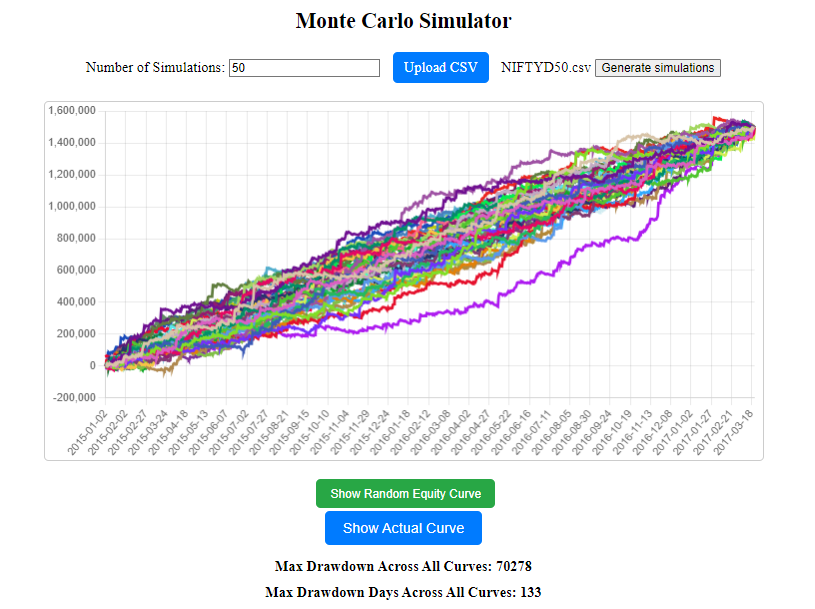

- Specify Simulation Parameters: Enter the number of simulations you wish to run in the designated input field. This parameter determines the number of random simulations the system will perform to analyze the trading strategy.

- Generate Simulations: Click the “Generate Simulations” button to initiate the Monte Carlo simulation process. If you haven’t uploaded a CSV file, the system will use default sample data for demonstration purposes.

- Analyze Results: Once the simulations are completed, the system will display the equity curves representing different possible outcomes of your trading strategy. You can visually inspect these curves to understand the range of potential performance scenarios.

- Max Drawdown: The system calculates the Maximum Drawdown (Max DD) and its duration across all simulations. Max DD represents the largest loss experienced by the trading strategy over a specific period, providing insights into its risk exposure and downside potential.

- Review Max Drawdown Metrics: Analyze the Max DD value and its duration displayed on the interface. These metrics offer valuable insights into the worst-case scenario performance of your trading strategy, aiding in risk management and strategy refinement.

- Iterative Improvement: Repeat the simulation process with different parameters or updated data to iteratively refine and optimize your trading strategy.

Conclusion:

In conclusion, Monte Carlo simulation serves as a valuable tool for traders to assess the performance and risks associated with their trading strategies. By analyzing multiple simulations, traders can gain insights into potential outcomes, identify maximum drawdowns, and refine their approach to risk management.

We also invite you to explore our Risk of Ruin calculator, which offers further insights into the probability of experiencing catastrophic losses based on your trading strategy and risk parameters. This additional tool can provide a comprehensive understanding of the risks involved in your trading activities.

We value your feedback and suggestions for improving our tools and services. Please feel free to comment below if you have any additional features you’d like to see or any other feedback you’d like to share. Your input helps us enhance our offerings to better meet your trading needs.