Getting an IPO allotment these days can be as challenging as climbing Mount Everest, especially for companies with good Business and strong fundamentals. An IPO (Initial Public Offering) comes into the picture when companies list their shares for trading in the capital markets to raise money to fund their business expansion.

we’ll look at it from the perspective of a retail investor. Typically, about 35% of the IPO shares are kept for retail investors, as mandated by SEBI (Securities and Exchange Board of India). If you’re an individual, you can invest a maximum of 2 lakhs. If you go beyond this limit, you become a High Net Worth Investor (HNI).

When you apply for an IPO, it’s like entering a lottery system. It becomes a bit uncertain if there are more applications than available shares. Sometimes, you might get a guaranteed allotment if only a few investors apply.

In this article, I’ll help you easily check your IPO allotment status with just one click.

Required Steps to check IPO allotment status:

Behind the scenes of every IPO, there’s a registrar hired by the company to handle the allotment process and calculations. Once the registrar finishes crunching the numbers for the allotment, they kick off the process of sending SMS alerts to all the lucky allottees.

However, in some cases, you might need to take a quick trip to the registrar’s website to check your IPO allotment status. Don’t worry, Here is the list of registrars working in Indian markets:

You can also visit the BSE website to check the allotment status using these steps:

- Go to the BSE’s website and choose the ‘Status of Issue Application’ option.

- Next, select ‘Equity’ under the ‘Issue Type’ section.

- Now, you will have to pick the desired company name from the dropdown menu.

- Then, provide the necessary details, such as the application number or PAN number.

Verifying Successful IPO Allotment:

Finding out if you have an IPO allotment can be easy with a simple check in your bank account. When you apply for an IPO, some money in your bank account gets temporarily set aside. Once the registrar finishes the allotment, you’ll get an SMS. If the allotment is successful, the message will tell you a certain amount has been taken from your bank account. This SMS is a clear sign that you’ve successfully got shares in the IPO.

Key Elements Shaping the IPO Allotment Decision:

-

Fundamentals: A company’s strong fundamentals and good balance sheet can increase the interest of investors. It can potentially drive a rise in the demand for shares causing an oversubscription.

- Retail Vs. FII&DII: When it comes to getting shares from companies, both retail and institutional investors are typically allotted a percentage. This allocation ratio considers the overall demand from these two important categories of investors.

- Oversubscription: An oversubscribed IPO attracts eager investors with its growth potential. With many investors rushing toward it, the IPO number can go up significantly.

Understanding How IPO Allotment Decisions are Made:

The IPO application’s best outcome depends on two situations:

- Scenario 1: When the total bids are less than the company’s available shares, the Registrar doesn’t need to step in. Qualified investors will get their desired shares without any extra procedures.

- Scenario 2: If the total bids surpass the company’s offered shares, the Registrar has to figure out how to distribute them. It’s crucial to follow SEBI’s rules in this case to make sure each application gets at least one share..

Conclusion:

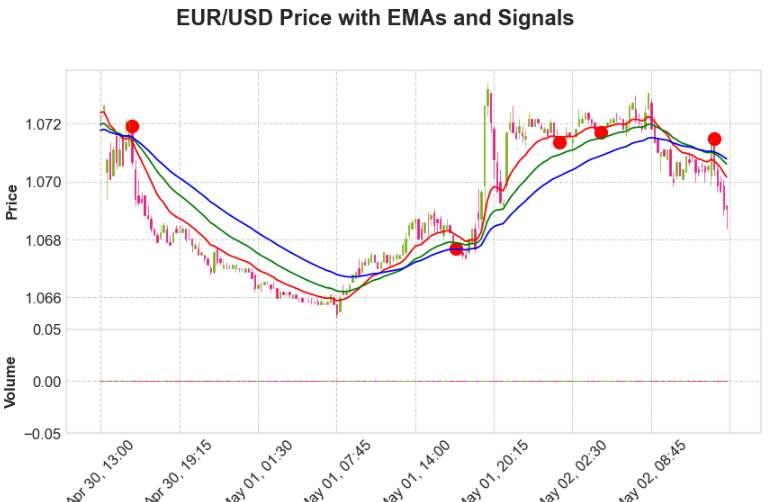

In conclusion, staying informed about your IPO allotment is just a click away. Visit your registrar’s website or the BSE/NSE platform within a week of the closing date to promptly access the status and stay updated on your investment journey. You Can Check My Latest Post on How To Backtest Ema Crossover Trading Strategy Here. Happy investing!