When it comes to backtesting in Forex trading, having good software is important. Two popular options are Forex Tester and FX Replay. Both offer unique features and benefits. Let’s look at what they offer, compare them, and explore some alternatives.

Forex Tester Overview

Forex Tester is a well-known backtesting software that helps traders test their trading strategies using historical data. Here are some key points:

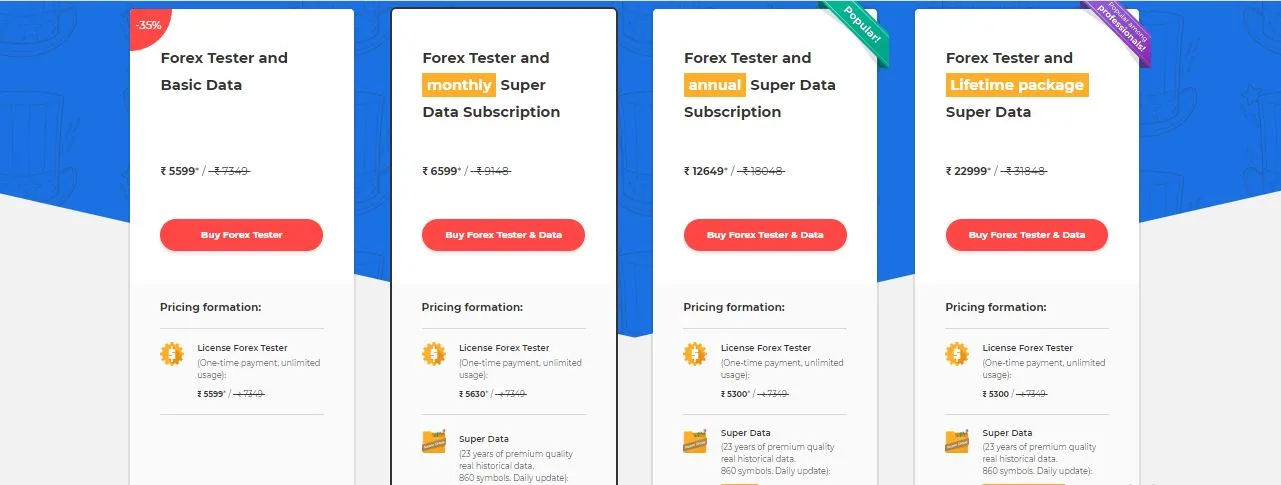

- Cost: Forex Tester costs $100 for basic data and $275 for lifetime data and updates. This makes it a cost-effective option over time because you pay only once.

- Historical Data: You can get lots of old data to test your strategies. Some of this data requires a subscription, but the lifetime option covers everything.

- Ease of Use: The interface is simple and easy to understand, making it accessible for traders of all levels.

- MetaTrader Integration: You can test MetaTrader Expert Advisors (EAs) with Forex Tester, which is useful for those who use MetaTrader for trading.

- Platform Compatibility: Forex Tester works best on Windows, but you can use it on Mac and Linux with a virtual machine (VM).

Pros:

- One-time payment is cost-effective in the long run

- Extensive historical data is available

- User-friendly interface

- Compatibility with MetaTrader EAs

Cons:

- Some historical data requires a subscription

- Not browser-based, which means you need to install it on your computer

FX Replay Overview

FX Replay offers a modern approach to backtesting, using the TradingView charting interface. Here are its key features:

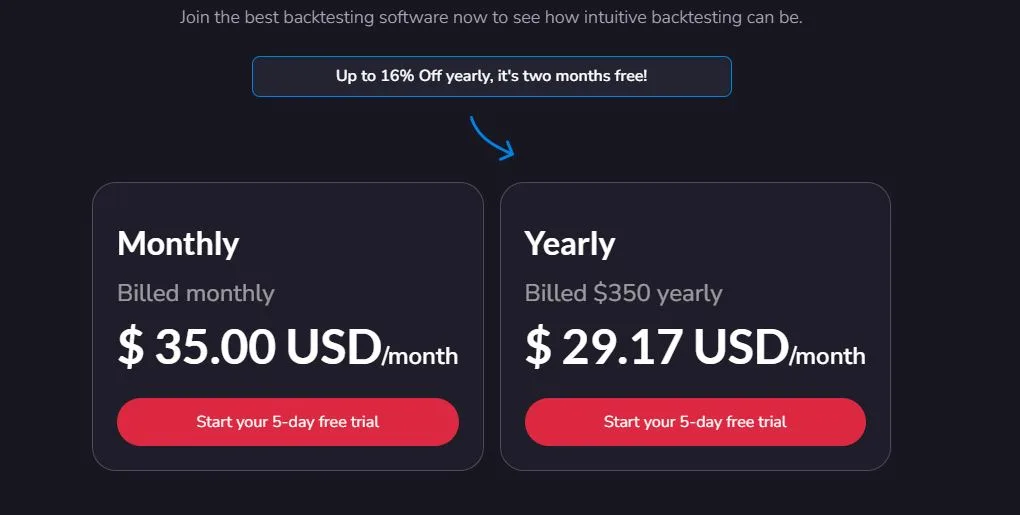

- Cost: FX Replay costs $35 per month or $350 per year, with no lifetime subscription option. This makes it more expensive over time compared to Forex Tester.

- Browser-Based: FX Replay is accessible from any device with a browser, so you don’t need to install any software.

- TradingView Integration: It uses TradingView charts, which are known for their quality and user-friendliness.

- Custom Indicators: FX Replay has special custom indicators that are not available on other platforms.

Pros:

- No need to install software; accessible via browser

- High-quality TradingView charts

- Continuous updates with the subscription

Cons:

- Subscription fees can add up over time

- No automation tools for automated strategy testing

- Simplistic interface that lacks some advanced features

Detailed Comparison:

Cost: Forex Tester’s one-time payment of $100 for basic data or $275 for lifetime data is cheaper in the long run compared to FX Replay’s ongoing subscription of $35 per month or $350 per year. You can compare the plans of both on their respective web pages they also have a 5-day trial period which is more than sufficient for a detailed analysis of software and your needs.

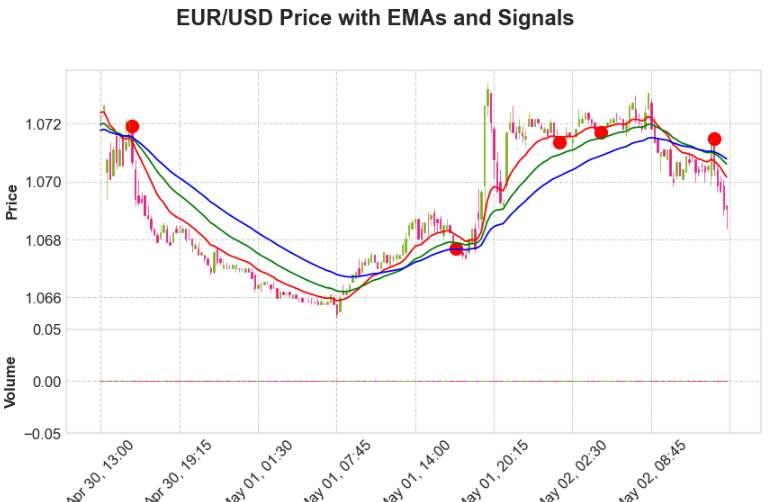

Data and Analytics: Forex Tester provides lots of historical data, though some require a subscription. FX Replay, using TradingView charts, offers high-quality visuals but fewer data analysis tools.

Ease of Use: Both platforms are user-friendly. Forex Tester is good for those familiar with MetaTrader, while FX Replay’s browser-based use offers flexibility.

Advanced Features: Forex Tester supports MetaTrader EAs, making it ideal for automated strategy testing. FX Replay excels in manual backtesting with its TradingView integration but lacks automation tools.

Alternatives to Forex Tester and FX Replay

If neither Forex Tester nor FX Replay fully meets your needs, several alternatives offer a range of features and pricing models:

- Cost: One-time payment with no subscription fee.

- Historical Data: Includes updated historical data without additional costs.

- Fast Backtesting: Offers fast backtesting with drag-and-drop, no-code rules for automation.

- Superior Analytics: Provides comprehensive analytics tools.

Pros:

- No ongoing costs

- Excellent analytics and automation features

- User-friendly interface

Cons:

- Not browser-based

- Requires Windows or a VM for Mac/Linux

- Similar to Forex Tester but with additional features and updates.

- Cost: Low one-time cost.

- MetaTrader Integration: Converts MetaTrader 4 and 5 into backtesting platforms.

Pros:

- Cost-effective

- Utilizes existing MetaTrader data

Cons:

- Can be difficult to install and use

- Limited to manual backtesting

Free Alternatives of FXreplay

- Cost: Free software with no charge for the platform.

- Historical Data: Free data is available.

- Custom Indicators and EAs: Has a wide range of tools available online.

Pros:

- Completely free

- Extensive library of indicators and EAs

Cons:

- Manual backtesting is slower

- Requires use of spreadsheets for analysis

- Cost: Free software.

- Built-In Backtesting Features: More integrated tools than MetaTrader.

Pros:

- Free to use

- Integrated backtesting features

Cons:

- Connection issues can interrupt backtesting

- Limited markets available

FX Replay Features:

FX Replay is a newer platform that provides many benefits for Forex traders. Here is a summary of what it offers:

- Available Anywhere: Since it is browser-based, you can access FX Replay on any computer. This makes it very flexible.

- TradingView Charts: FX Replay uses TradingView charts, which are considered some of the best in the industry.

- Additional Features: FX Replay adds extra backtesting features on top of TradingView’s capabilities.

- Custom Indicators: It offers unique custom indicators not found on other platforms.

- Wide Range of Markets: You can backtest many different markets with FX Replay.

Benefits:

- You don’t need to install any software

- High-quality charts from TradingView

- Additional backtesting features that enhance TradingView

- Unique custom indicators

- Many markets available for backtesting

Downsides:

- It is a subscription service, so if you stop paying, you lose access to your data.

- Limited analysis metrics compared to other platforms

- No tools for automating your backtesting

- The interface is simple and might not have all the features advanced users need

Final Thoughts:

Choosing the right backtesting software depends on your specific needs, budget, and trading style. Forex Tester offers a cost-effective, comprehensive solution for those who prefer desktop applications and MetaTrader integration. FX Replay, with its browser-based platform and TradingView integration, provides flexibility and ease of access, ideal for manual backtesting enthusiasts.

For those seeking alternatives, NakedMarkets stands out as a powerful paid option with advanced features, while MetaTrader remains a robust free alternative. Evaluate your requirements and choose the software that best aligns with your trading goals.

By understanding the strengths and weaknesses of each platform, you can make an informed decision and enhance your backtesting process, ultimately leading to better trading performance.

You can check out this link to learn more about the top 5 forex backtesting softwares.