Why Should I Invest?

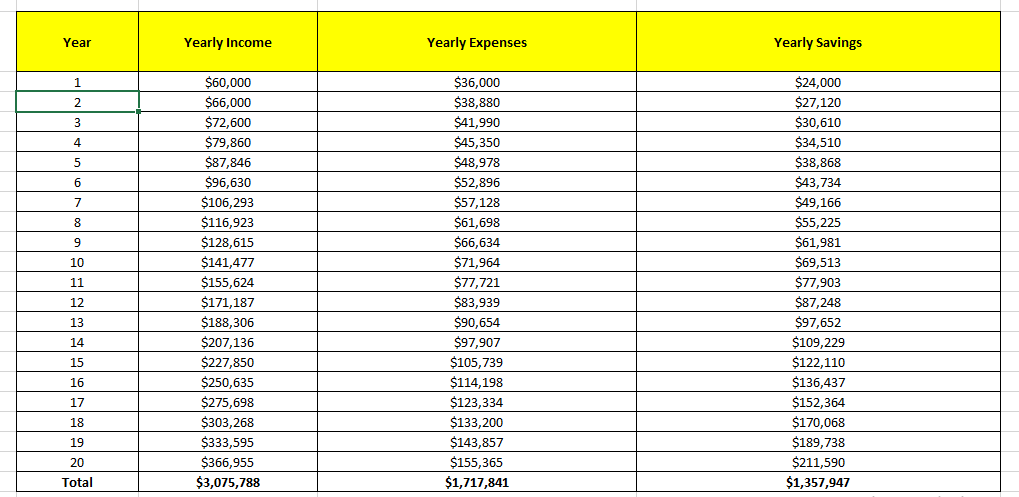

Let’s start by imagining a scenario where you decide not to invest. You have a steady job earning $5,000 a month, and after covering your living expenses of $3,000, you’re left with a $2,000 surplus each month. Now, let’s see what happens if you just save that money in a bank account over the next 20 years.

We’ll make a few simple assumptions:

- Your salary increases by 10% annually.

- Your living expenses rise by 8% each year.

- You plan to retire in 20 years at age 50.

- You don’t plan to work after retirement.

Here’s a snapshot of your financial journey without investing:

After 20 years, you’d have saved about $1.36 million. But with your expenses increasing yearly, that amount might only last you around 8 years after retirement. This is a bit worrying, isn’t it?

The Difference with Investing

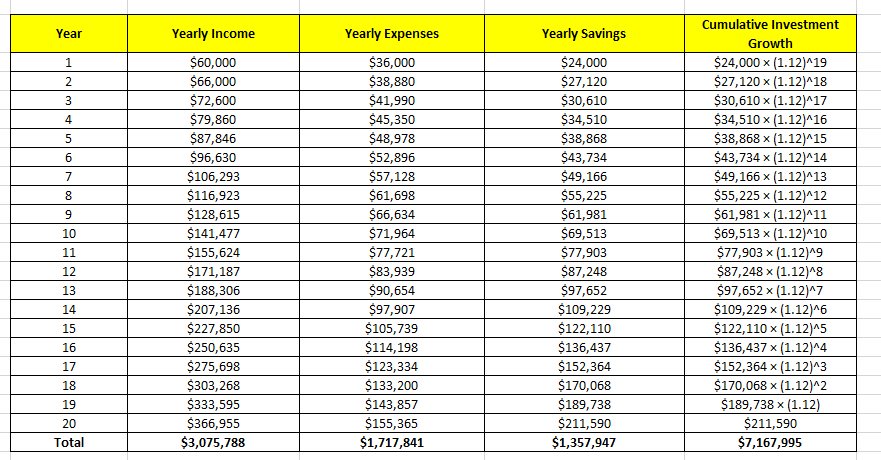

Now, let’s see what happens if you invest your surplus at an average annual return of 12%.

For simplicity, we’ll assume that you invest each year’s savings at 12% for the remaining years. Here’s how your savings grow with investing:

By investing, you accumulate around $7.17 million, significantly more than the $1.36 million from just saving. This shows the power of compound growth and the critical role investing plays in securing your financial future.

Why Invest?

Investing isn’t just about growing your wealth; it’s about ensuring you can live comfortably in the future. Here are a few key reasons to invest:

- Combat Inflation: Over time, inflation erodes the purchasing power of your money. Investing helps your savings grow faster than inflation.

- Build Wealth: Investing allows your money to work for you, generating returns that compound over time.

- Achieve Financial Goals: Whether it’s buying a home, funding your children’s education, or enjoying a worry-free retirement, investing helps you meet these goals.

Where to Invest?

Choosing where to invest depends on your risk tolerance, financial goals, and investment horizon. Here are some common investment options:

Fixed Income Instruments

These are considered safe investments as they protect your principal and offer regular interest payments. Examples include:

- Bank Certificates of Deposit (CDs)

- U.S. Treasury Bonds

- Municipal Bonds

- Corporate Bonds

Returns on fixed-income instruments range from 1-6%, depending on the type and risk.

Equities

Stocks represent ownership in a company. While they carry higher risk, they also offer higher potential returns. Historically, the U.S. stock market has provided an average annual return of about 10%.

Real Estate

Investing in real estate can yield rental income and property appreciation. Rental yields typically range from 2-4%, while property values can appreciate significantly depending on the location and market conditions.

Commodities

Precious metals like gold and silver are considered safe investments with returns typically around 5-8% annually. These can be invested in via physical assets, ETFs, or mining stocks.

Things to Consider Before Investing

Before you start investing, consider these important factors:

- Risk and Return: Higher potential returns usually come with higher risk. Balance your portfolio according to your risk tolerance.

- Diversification: Don’t put all your eggs in one basket. Spread your investments across different asset classes to reduce risk.

- Investment Horizon: Your time frame for needing the money affects your investment choices. Longer horizons typically allow for more risk.

- Financial Goals: Clearly define your goals, whether it’s retirement, buying a home, or funding education, and choose investments that align with these objectives.

Conclusion

Investing is crucial for building a secure financial future. By understanding the options available and choosing investments that align with your risk tolerance and goals, you can protect against inflation, grow your wealth, and enjoy a better quality of life. Start investing wisely today and watch your money work for you!

Learn More about investing here.