Overview: Quantman And Tradetron

Hey there, fellow trading enthusiasts! So, I’ve been on this exciting journey into algo trading, and along the way, I stumbled upon two Algo trading platforms available in India – Quantman and Tradetron. Now, let me tell you, making this decision isn’t as straightforward as I thought!

First off, there’s Quantman, the new kid on the block. It’s got this cool focus on options trading strategies without any coding need, which really caught my attention because, well, I’m all about exploring options. Then there’s Tradetron, which offers this bustling marketplace where you can buy and sell algo strategies. Pretty neat, right?

What’s really got me excited is how user-friendly both platforms are. I mean, they’ve got these drag-and-drop builders that make crafting strategies a breeze. And believe me, that’s a relief for someone like me who’s still finding their feet in the trading world.

As I weigh my options (pun intended), I find myself drawn to Quantman’s specialized backtesting for options. But then again, Tradetron’s marketplace and wide range of algos are seriously tempting.

So, if you’re on this algo trading adventure too, stick around as I dive deeper into Quantman and Tradetron. Let’s figure out together which one’s the perfect match for our trading dreams!”

Coding Requirements:

TradeTron – Tradetron comes with a highly customizable syntax-based approach. You should have a basic understanding of coding concepts, such as loops and functions, to build your strategy. However, you don’t need advanced coding knowledge.

Personally, I come from a non-coding background and began my algo trading journey with the help of Tradetron. They offer extensive documentation and YouTube tutorials on creating strategies, along with many templates for popular strategies in the market, like time-based straddles, strangles, and indicator-based strategies such as Supertrend and Bollinger Bands.

Quantman – In contrast, Quantman doesn’t require any coding at all. It employs a simple drag-and-drop approach, allowing you to build your strategy effortlessly.

Skill Level:

TradeTron – As mentioned earlier, while some coding knowledge is beneficial for using Tradetron, it doesn’t hinder your ability to pursue your strategy. In fact, it’s much simpler compared to building algorithms using Python or JavaScript. The skill level required to use Tradetron is basic, involving understanding indicators and market dynamics, such as how markets operate and order placement.

Quantman – On the other hand, Quantman doesn’t require any specific skills to begin. It’s a straightforward drag-and-drop software, requiring minimal effort for beginners compared to Tradetron.

Strategy Builder:

TradeTron – Algo platforms like Tradetron offer users a strategy builder tool crucial for creating strategies. This tool covers essential aspects such as timing (positional or intraday), order types, core rules, entry and exit conditions, and profit/loss parameters. Essentially, the strategy builder serves as the heart of these platforms, as without it, executing strategies would be impossible. Tradetron’s strategy builder is optimized and user-friendly, utilizing provided syntax to customize strategies efficiently. Unlike Quantman, Tradetron offers extensive customization options.

Quantman – Quantman’s strategy builder takes simplicity to another level, employing a straightforward drag-and-drop interface. Users can easily search for indicators and integrate them into their strategies, with the builder guiding them through the process. This approach eliminates the need for special syntax and streamlines the strategy creation process.

Pre-Built Strategies:

TradeTron – At TradeTron, they provide a marketplace where users can share their strategies with others, earning royalties in return. This marketplace is particularly valuable for newcomers to algorithmic trading, offering a hassle-free entry into the field.

By purchasing a strategy from the marketplace, users can gain insight into algorithmic trading without the complexities. It’s an opportunity to observe how strategies perform over one or two months, helping newcomers acclimate to the stress of algorithmic trading. Marketplace strategies come equipped with essential parameters like backtested data, Sharpe ratio, and Calmar ratio, making deployment straightforward and informed.

Quantman – Similarly, Quantman offers a marketplace feature, providing detailed strategy data and past performance metrics. Users can easily purchase strategies based on their preferred past performance and deploy them with a single click. This marketplace serves as a springboard for newcomers in the algorithmic trading field, offering a convenient entry point for those unfamiliar with the intricacies of algorithmic trading.

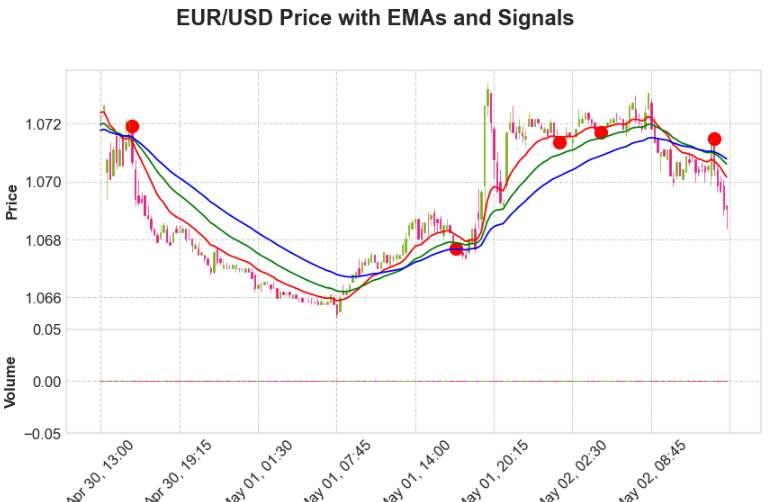

Backtesting:

TradeTron – Backtesting is the backbone of any successful algo trading strategy, as it allows us to gauge how a strategy might perform in the future based on past data. TradeTron offers a powerful backtesting engine that enables users to test their rules on historical data within seconds, providing results in a matter of moments.

This engine is meticulously optimized for performance, allowing users to backtest numerous strategies without encountering any issues. Additionally, TradeTron provides detailed backtest reports, simplifying the comparison of different strategies and aiding in the selection of the most effective ones.

Quantman – Quantman boasts one of the finest backtesting engines on the market, renowned for its remarkable speed. With Quantman, users can backtest countless strategies within seconds, thanks to its lightning-fast engine. The insights provided by Quantman’s backtester are invaluable for analyzing strategies across various time frames and with different indicators. Moreover, Quantman offers the option to save backtests, enabling users to refine strategy parameters and optimize performance at their convenience.

Paper Trading:

TradeTron – TradeTron offers a paper trading feature, allowing users to simulate trades without placing orders in the live market. This approach provides an initial confidence boost, reassuring users that their strategies are effective and likely to perform well in live market conditions.

Quantman – Similarly, Quantman provides a paper trading feature, enabling users to paper trade as many strategies as they wish. This feature allows users to test strategies in a risk-free environment before committing to live trading.

Live Trading:

TradeTron – Live trading is a cornerstone feature of any robust algo trading software, allowing users to execute live orders in the market. TradeTron seamlessly integrates with various broker APIs, enabling users to place orders effortlessly through supported brokers such as Zerodha, Upstox, and Finvasia, among others. With TradeTron, order execution is swift, typically taking less than a second once a signal is generated. Users can monitor their live P&L data, track open and closed orders, and access various other features to stay informed about their strategy’s performance in real-time.

Quantman – Similarly, Quantman facilitates live execution by allowing users to connect with their broker accounts directly within the platform. Once logged in, users can place orders across all supported brokers with ease. The execution process is fast and seamless, with no noticeable lag or delays. With Quantman, users can execute trades confidently, knowing that their orders will be executed promptly and efficiently.

Pricing:

TradeTron – Tradetron’s pricing plans may seem relatively higher compared to similar platforms like AlgoTest, but they offer greater flexibility in logic creation, which can justify the pricing. You can explore Tradetron’s pricing plans [here].

Quantiply – Quantiply provides both monthly and yearly subscription options with a range of features including paper trading and unlimited backtesting. However, it’s worth noting that Quantiply’s pricing is not the most economical compared to other options in the market. You can view Quantiply’s pricing plans [here].

Customer Support:

TradeTron – TradeTron provides comprehensive support through phone, email, and chat channels. Users have consistently praised the support team for their helpfulness and expertise, reporting positive experiences.

Quantman – Quantman offers support via email and phone, with dedicated numbers for various languages. However, there’s limited information available regarding the quality of customer support provided by Quantman.

Final Thoughts:

In summary, both Tradetron and Quantman offer distinct features and cater to different user needs. Tradetron excels in its syntax-driven approach and high customizability, while Quantman stands out for its indicator-based trading and unique backtesting capabilities. To determine which software suits you best, I recommend testing them through paper trading or live trading for a month or two. With several options available in the market, including AlgoTest, Quantiply, and Stoxxo, there’s ample opportunity for algo trading in the Indian market. For more information on these software options, feel free to check out my blog on the top 5 algo trading software in India. With that, we conclude this comparison.