Black Scholes IV(implied volatility) calculator.

What is Black Scholes Model

Options trading is a dynamic aspect of financial markets, offering flexibility in risk management and profit potential. Central to this practice is the ability to accurately price options before making trading decisions. The Black Scholes option pricing model, developed by Fischer Black, Myron Scholes, and Robert Merton in the early 1970s, plays a pivotal role in this process, providing a mathematical framework widely used by traders and analysts.

Demystifying the Black Scholes Model:

The Black Scholes model revolutionized options pricing by introducing a systematic approach to calculate the theoretical value of European-style options. At its core, the model considers key factors:

- Underlying Asset Price (S): Current market price of the asset the option is based on.

- Strike Price (K): Agreed-upon price at which the option holder can buy (call) or sell (put) the asset.

- Time to Expiry (T): Duration until the option expires, typically measured in years.

- Risk-Free Interest Rate (r): The return rate on risk-free investments during the option’s lifespan.

- Volatility (σ): Degree of price fluctuation of the underlying asset over time.

- Option Type: Whether it’s a call option (to buy) or a put option (to sell) the asset.

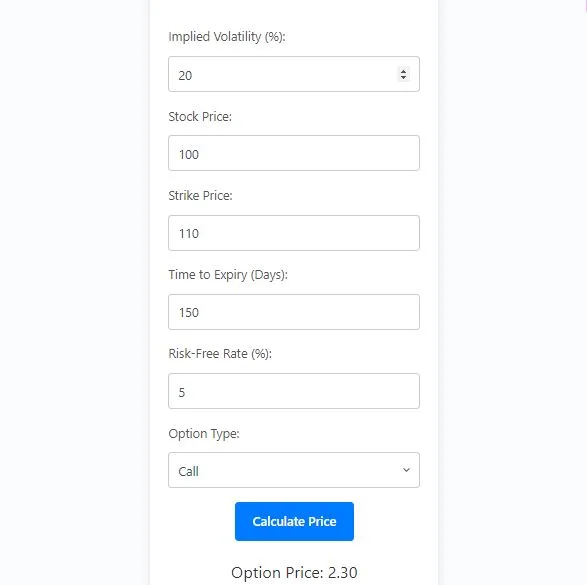

Applying the Black Scholes Formula: A Practical Example

Let’s apply the Black Scholes formula with a hypothetical scenario. Imagine a stock priced at $100 per share, with a strike price of $110, expiring in 6 months. Assuming a volatility of 20% per year and a risk-free rate of 5% per year, how do we calculate the option price?

As you can see in this picture, the option price is $2.30, which we calculated using the black scholes option price calculator model.

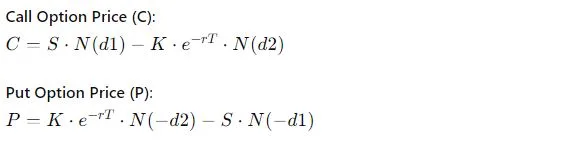

Black Scholes Formula:

The Black-Scholes model provides formulas to calculate the theoretical price of European-style call and put options. Here are the key formulas:

You can learn about Black Scholes Model Here.

Conclusion:

In summary, the Black Scholes model remains a cornerstone in options pricing, offering insights and strategies that empower traders to capitalize on opportunities while managing risks prudently. By integrating this knowledge into your trading approach, you can elevate your financial decision-making and achieve greater success in the dynamic world of options trading.

I Hope you liked our black-scholes model calculator. You can check out other calculators built by us here.