Implied Volatility Calculator Black Scholes

Check Black Scholes Option Price Calculator here.

Implied volatility (IV) is a key concept in options trading that tells us how much the market expects a stock’s price to fluctuate in the future. It’s an essential metric derived from the Black-Scholes model, a fundamental formula used to price European-style options. Our Implied Volatility Calculator simplifies the process of calculating IV, providing valuable insights into potential stock price movements.

What is Implied Volatility?

Implied volatility (IV) is a measure of expected price swings in a stock or other asset over a specific period. When IV is high, it indicates that traders expect significant price movements. Conversely, low IV suggests more stable price expectations.

Why Implied Volatility Matters?

Understanding IV is crucial for several reasons:

-

Option Pricing: IV directly impacts the prices of options. Higher IV leads to higher option premiums because of increased uncertainty and potential for larger price swings.

-

Risk Assessment: IV helps traders evaluate the risk associated with options. Higher IV means greater uncertainty and risk, influencing trading strategies and risk management decisions.

-

Market Sentiment: IV also reflects market sentiment. High IV may indicate fear or anticipation of significant market moves, while low IV may indicate market stability.

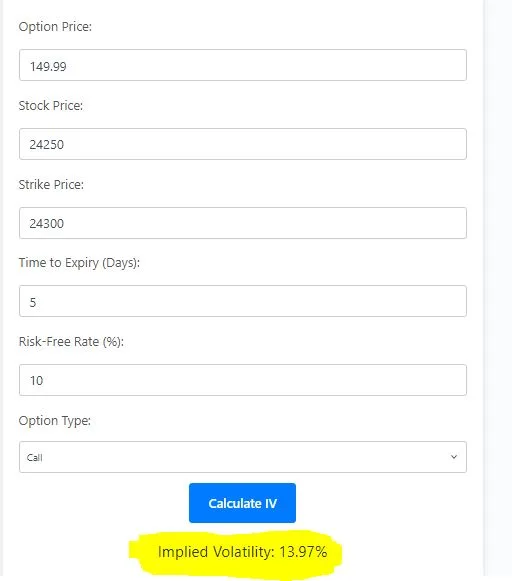

How to Use Our Implied Volatility Calculator:

Our Implied Volatility Calculator uses the Black-Scholes model to calculate IV based on key parameters:

- Option Price: The current market price of the option.

- Stock Price: Current market price of the underlying asset.

- Strike Price: The price at which the option can be exercised.

- Time to Expiry (Days): Remaining days until the option expires.

- Risk-Free Rate (% Annual): The prevailing risk-free interest rate.

- Option Type: Choose between Call or Put options.

Simplified Calculation Process:

- Enter Your Data: Input the required details into the calculator.

- Calculate IV: Click the “Calculate IV” button to see the result.

- Result Display: Instantly view the calculated Implied Volatility as a percentage.

Conclusion:

Our Implied Volatility Calculator is designed to empower traders with the tools they need to navigate the complexities of options trading. Explore the dynamics of IV and its impact on options pricing with confidence and clarity.

You Can use more calculators built by us here.